financials

[The figures in on this page can only be seen properly in the black mode of the site - see the button at the top right]

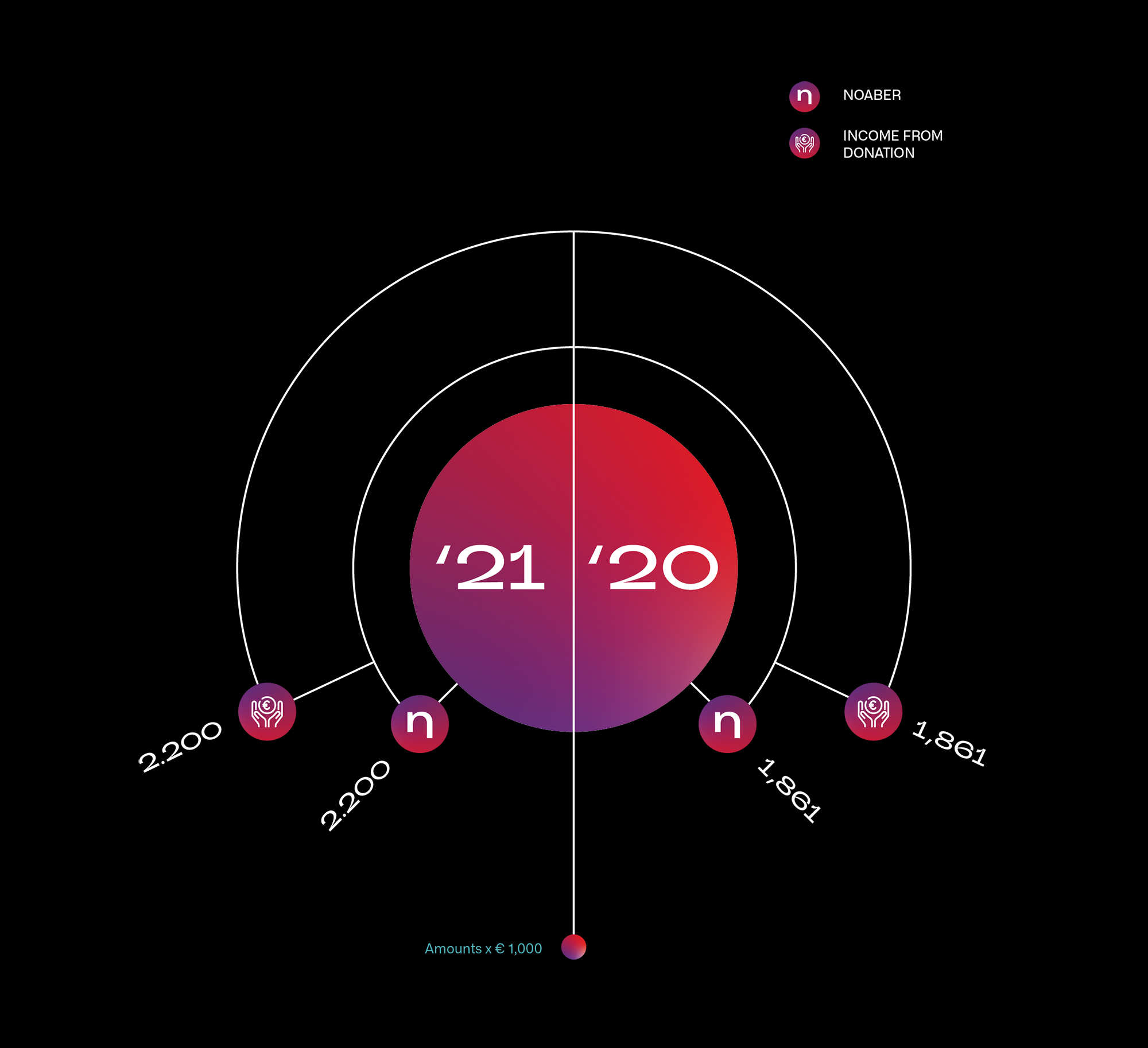

FUNDING

In 2021 Noaber Foundation received the majority of its funding through a donation from a related trust fund. The level of funding increased compared to prior years, although no funding was generated through (exits from) participations held by Noaber Ventures that were distributed to Noaber Foundation.

Noaber continues to strive to accelerate its impact through driving change, improving health. During 2020, Noaber evaluated its longer term ambition and the associated funding for the coming years which resulted in an increased funding need. Following discussions, the related trust fund committed to an increased donation for 2021, and the intent is to maintain that for the coming years. Therefore, for 2022 and beyond we expect a similar level of funding compared to the 2021 level.

The investments made by Noaber Ventures are considered an instrument that help to achieve the impact objective for Noaber Foundation in an entrepreneurial fashion. In 2022 and beyond, Noaber Ventures will continue to build its portfolio towards a more mature level and therefore will likely reinvest its income from participations in its impact investing portfolio. Distributions from Noaber Ventures to Noaber Foundation are not expected in the coming years.

EXPENDITURES

The policy for Noaber Foundation is that at least 40% of funding received from the related trust fund is allocated towards program related expenses, while the remainder can be applied for impact investments through Noaber Ventures. During the past few years the Board decided to deviate from the policy and allocate all available means, beyond organizational costs, to donations and program related expenses. This decision was prompted by the level of commitments made, the pipeline for donations, and the increasing level of proceeds from portfolio companies within Noaber Ventures enabling further impact investments without additional capital contributions. It is expected that this full allocation towards program related expenses will continue for the coming years.

For the past few years, program related expense (including organizational costs) have been on a relatively stable level. Variations are mainly due to accounting principles that deviate from the cash basis of budgeting within Noaber. Donations granted in 2021 were on a relatively lower level as new projects granted and new programs initiated were relatively smaller in size compared to previous years.

In 2021 no capital contributions for impact investments through Noaber Ventures have been made following sufficient available proceeds from (prior) portfolio companies that are reinvested through Noaber Ventures. This trend is expected to continue in the next years as a result of which the need for capital contributions in the coming years is expected to be minimal.

Noaber Foundation takes a complete capital approach towards its activities. Our contributions are not merely measured by the financial resources directly granted to other organizations but also through our own activities, initiatives, and resources. We believe we can increase the efficiency and effectiveness of our innovation programs through an active approach taking initiative, building multi-stakeholder collaborations, facilitating sharing of experience, knowledge, and network and providing strategic and operational support to our projects and participations.

This approach is reflected in the organizational costs. We regard these organizational costs as investments into the impact achieved by the activities of Noaber Foundation. The strategic approach adopted by Noaber Foundation reflects our commitment towards an initiating, active and engaged approach (driving change) to facilitate a system level change steered towards health span and quality of life (improving health) as a result of which we expect the organizational costs to increase in the coming years. They are considered an essential and integrated part of our innovation programs. This was already visible in 2021 when organizational costs increased compared to 2020.